Introduction

Are you trying to find the simplest way to get the financial solutions offered by Triumph Business Capital?

You’ve found it! Getting access to the resources you require is made simple with our Triumph Business Capital Login tutorial. You can rapidly get up and running with a few clicks. We will guide you through opening a Triumph Business Capital account so you may use the right financial tools and solutions for your company. Take advantage of Triumph Business Capital’s finance options right away!

Understanding Triumph Business Capital

Let’s take a moment to explain Triumph Business Capital and discuss why it’s a valuable tool for companies before moving on to the login procedure.

Financial services provider Triumph Business Capital specializes in assisting companies in realizing the value of their unpaid debts. Triumph gives businesses the working capital they require to expand and prosper through invoice factoring. Also, they provide supply chain finance options to assist businesses in effectively managing their finances.

Let’s now study how to log in to Triumph Business Capital.

A Step-by-Step Guide: Triumph Business Capital Login

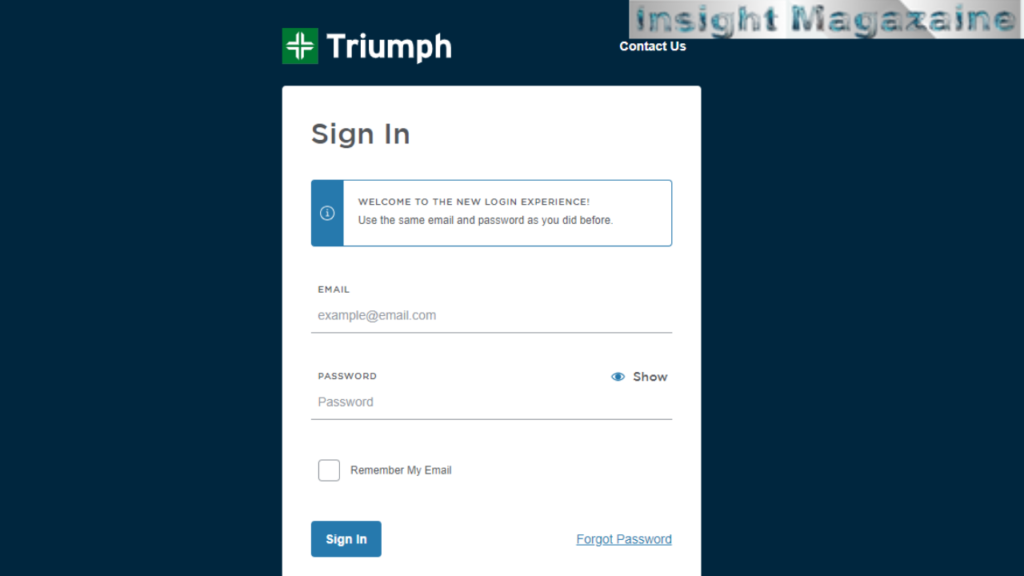

Go to the Official Web Page

The first step is to open a web browser and go to the Triumph Business Capital website. Enter “Triumph Business Capital” into your chosen search engine.

Look for the Login Button

Find the button “Login” or “Client Login” on the homepage of the website, this button can be found in the top right corner of the website.

Type Your Credentials Here

When you click the “Login” button, it will open a secure login page. Your username and password, which were given to you when you registered for Triumph Business Capital services, must be entered.

Link to Your Account

Click the button “Log In” after giving your login information. You will be given access to your Triumph Business Capital account, where you may select from many financial services developed specifically for the requirements of your company.

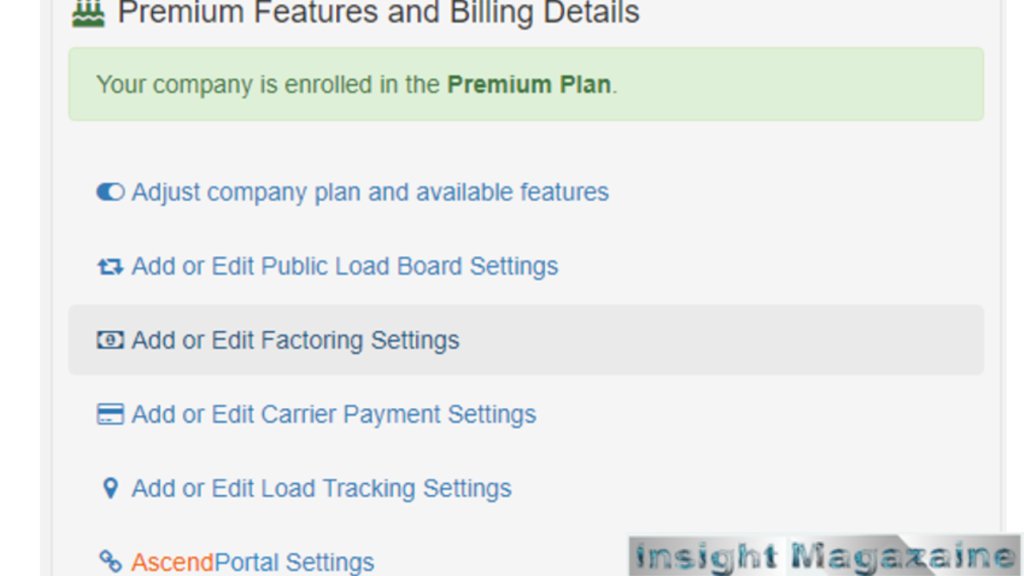

Features of Triumph Business Capital

Now that you know how to access your account, let’s talk about the features of working with Triumph Business Capital.

Increased Cash Flow: You can get access to the money stored in the balance of your invoices by using Triumph Business Capital’s invoice factoring services. For companies wishing to finance running costs, make investments in expansion, or capture new opportunities, this could prove to be a game-changer.

Easy and Quick Access: You may manage your finances easily with the Triumph Business Capital login page. You can analyze your bills, keep track of payments, and make wise financial decisions whenever you choose thanks to constant access to your account.

Professional Support: Triumph Business Capital gives customized advice and financial direction to promote the growth of your company. Your queries can be answered and you can get assistance navigating the financial system from their team of professionals.

Customized Solutions: Triumph Business Capital is aware of the individuality of every company. Whether you’re a small startup or a huge enterprise, they offer flexible financial solutions to match your unique demands.

Improve Your Triumph Business Capital Experience

Checking of financial statements: To understand the financial health of your business, it is crucial to frequently analyze your financial statements. It enables you to maintain tabs on your earnings, outgoing costs, and cash flow so you can manage your finances with Triumph Business Capital with confidence.

Use invoice factoring: A useful tool offered by Triumph Business Capital Login is called invoice factoring. You can use it to instantly convert unpaid bills into cash. By utilizing this service, you may improve your cash flow and make sure you have the resources necessary to efficiently run and expand your firm.

Keep an eye on your credit: To help you keep track of the credit standing of your business, Triumph Business Capital offers credit monitoring services. Maintaining a solid financial reputation depends on being able to identify and address possible issues early on thanks to credit monitoring.

Pros

- The lender specializes in factoring invoices.

- Offers factoring that is both recourse and non-recourse.

- True factoring business that manages payment collection and offers online tracking.

- Flexible qualification standards that are open to new firms and those with less-than-ideal credit.

Cons

- Harder to fund than other possibilities.

- Have an Origination fee.

- No details about the range of factor fees are provided.

- Complete credit check while applying.

Conclusion

Your entrance to a world of financial opportunities is the Triumph Business Capital login process. Triumph Business Capital helps companies maximize their cash flow and meet their growth goals by giving them simple access to invoice factoring and supply chain finance services.

Triumph Business Capital is very great and helpful. If you want to enhance the financial stability of your company or business. You can use their services by simply sticking to the directions in this guide. Don’t pass up the chance to use Triumph Business Capital to simplify your cash flow and advance your company.

FAQs

Is Triumph Business Capital suitable for small businesses?

Absolutely! The diverse range of businesses Triumph Business Capital deals with includes small and medium-sized businesses.

How safe is Triumph Business Capital?

To keep your information safe and secure, Triumph Business Capital is guarded by security methods and encryption technology that dominate the industry.

How to forget a password?

If you forget your password, You can get your password back by clicking the “Forgot Password” link that is located at the top of the page.

Also Read: https://insightmagazaine.com/hd-intranet/